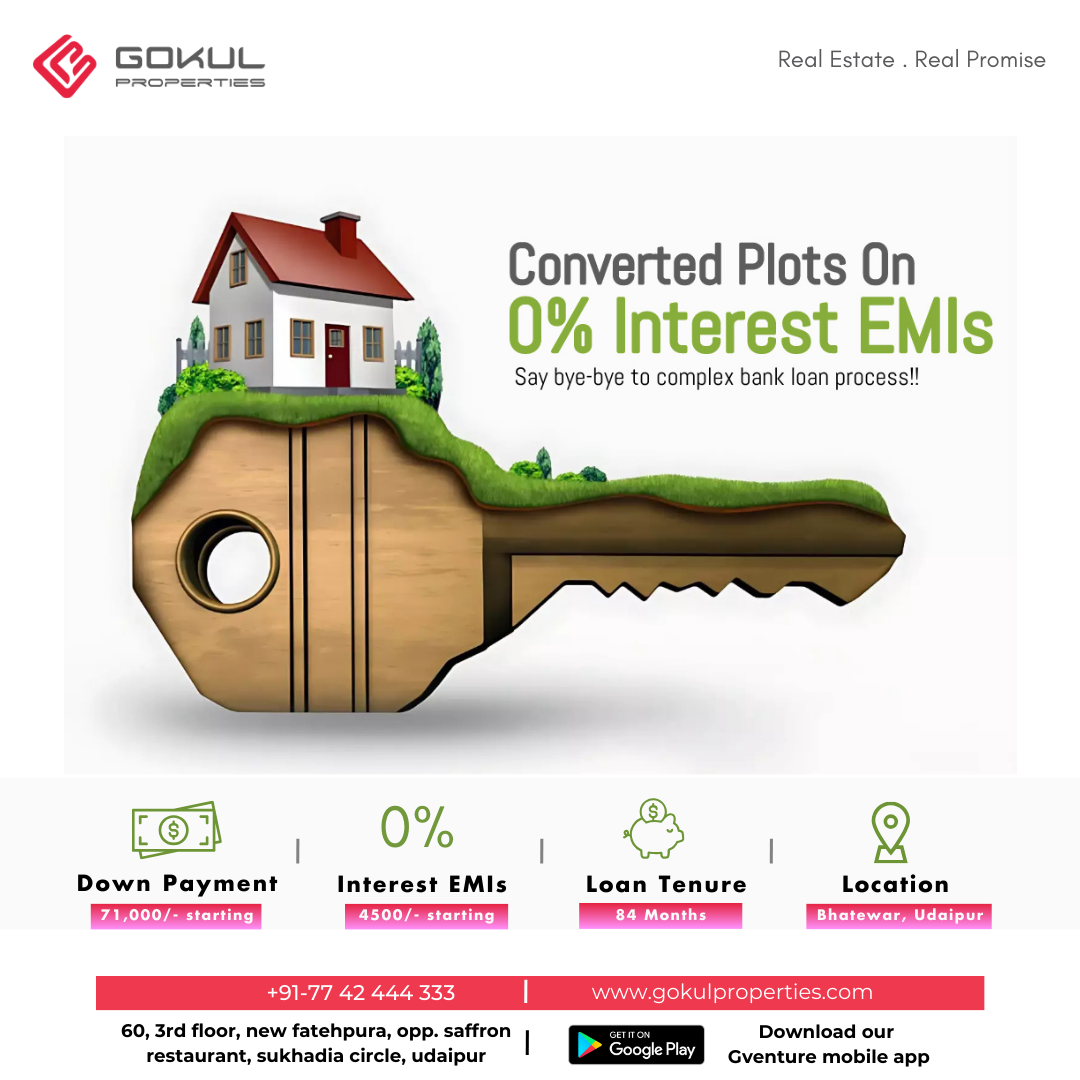

Investing in real estate is often seen as a venture for the older and financially stable. However, starting young can yield significant benefits, setting a solid foundation for long-term wealth and financial security. Let’s explore why it’s crucial to begin investing in real estate from an early age and how it can pave the way for a prosperous future. The Power of Time One of the most compelling reasons to start investing early is the power of time. Real estate, much like other investments, benefits immensely from long-term appreciation. Properties tend to increase in value over time, and the earlier you start, the more time you give your investments to grow. This long-term appreciation can significantly boost your net worth, providing substantial returns by the time you’re ready for retirement. Building Wealth Through Equity When you invest in real estate, you gradually build equity. Equity is the portion of the property that you truly own, which increases as you pay down your mortgage and as the property’s value rises. Starting young means you have more years to build this equity, which can be leveraged later for further investments, buying additional properties, or funding major life expenses. Generating Passive Income Real estate can provide a steady stream of passive income, especially if you invest in rental properties. Starting early allows you to develop a portfolio of rental properties that generate consistent rental income. This can be a powerful source of financial independence, reducing reliance on traditional employment and offering greater financial freedom. Learning and Growth Investing in real estate is not just about financial gains; it’s also about personal and professional growth. The earlier you start, the more time you have to learn about the market, develop investment strategies, and gain valuable experience. This knowledge can be invaluable, helping you make informed decisions and avoid common pitfalls. Tax Advantages Real estate investments come with various tax benefits, such as deductions for mortgage interest, property taxes, and depreciation. These advantages can significantly reduce your tax burden, allowing you to reinvest more of your earnings. Starting early maximizes the long-term tax benefits, contributing to overall financial health. Diversification of Investments Diversifying your investment portfolio is crucial for managing risk, and real estate is an excellent way to achieve this. By starting early, you can balance your investments between real estate and other asset classes like stocks and bonds. This diversification helps protect your financial future against market volatility. A Tangible Asset Unlike stocks or bonds, real estate is a tangible asset. Owning property provides a sense of stability and security, as it is a physical investment that you can see and touch. This can be particularly reassuring during times of economic uncertainty. Conclusion: Invest with Us for a Secure Future Starting early in real estate investment offers numerous benefits, from building wealth and generating passive income to gaining valuable experience and enjoying tax advantages. At gokul properties, we make it easy for young investors to start their real estate journey. We offer plots on affordable down payments and 0% interest EMIs, making it accessible for everyone to begin building their future today. Invest with us and take the first step towards financial freedom and long-term security.

Read MoreCategory: Uncategorized

Things to keep in mind while investing in plots in Outskirts of Udaipur

Udaipur is a city that has been attracting a lot of attention from real estate investors in recent years. As the city continues to grow, more and more people are looking to invest in plots in the outskirts of Udaipur. However, there are certain things that one should keep in mind while making such an investment. In this blog, we will discuss some of these key factors to help you make an informed decision. Location: The first and foremost thing to consider when investing in a plot is its location. The outskirts of Udaipur are vast and varied, so it is important to choose a location that is easily accessible and has good connectivity to the city. Areas that are closer to major 6 lane highways like dabok-bhatewar extension or upcoming infrastructure projects may have better potential for growth and development. Price: The price of the plot is another important factor to consider. While it may be tempting to invest in a plot that is priced lower than the market rate, it is important to do your research and make sure that the price is justified. Look at the prices of plots in the surrounding areas to get an idea of the market rate. Legal Status: Before making any investment, it is essential to check the legal status of the plot. Make sure that the plot is free from any legal disputes or encumbrances. Check the ownership documents and ensure that they are clear and free from any discrepancies or search for best property dealers in Udaipur for consultation, they will guide you through the complicated legal procedures Infrastructure: The availability of basic infrastructure such as water, electricity, and sewage facilities is another important factor to consider. Plots that have access to these facilities are likely to be more attractive to potential buyers in the future. Future Development: Look for areas that are likely to witness development in the near future. Check for upcoming projects such as highways, airports, industrial zones, and other infrastructure projects that can potentially increase the value of the plot in the long run. Surrounding Amenities: Plots that are located in areas that have access to amenities such as aiport, hospitals, shopping centers, and public transportation are likely to be more attractive to potential buyers. These amenities not only increase the value of the plot but also make it a more livable and desirable location. Resale Value: Finally, it is important to consider the resale value of the plot. Look for areas that have a high demand for real estate and are likely to witness appreciation in the future. This will ensure that you can get a good return on your investment in the long run. In conclusion, investing in a plot in the outskirts of Udaipur can be a lucrative opportunity if done carefully and strategically. Make sure to consider all the above factors before making your investment decision. With the right research and due diligence, you can ensure that your investment in Udaipur real estate is a profitable one. Gokul Properties, has experience of over 15 years and has delivered more than 13 lac sqft of land, they can help you in deciding where to invest in affordable plots in Udaipur and they will guide you through the whole process .

Read MoreFarm Land Investment: New Trend In Udaipur Real Estate

Investors in India are now checking out innovative ideas to earn returns from their investments, with growing purchasing owner. One of the lucrative ways of investing is saturated in agricultural land. While a number of the investors retain such farm land as an asset. Who supports the growing market of animate fruits and vegetables, to supplement their income there’s a neighborhood of investors. If farm investment may be a safe option for parking one’s funds because the return on investment is typically quite the opposite investments and also lends safety to investors’ money, a number of experts have agreed after pandemic COVID-19 especially. Historically, farmland also offers higher total returns than many other sorts of land investments, and also exhibits a way lower level of risk. That’s because farmland continues to supply product that are in high demand and certain always will be: meats, grains, fruits, and vegetables. Additionally, even when the market is fluctuating farmland typically escapes such volatility and continue to appreciate its value over time. Udaipur – The second most beautiful city in the world According to travel & leisure magazine survey, Udaipur secured 2nd rank in the most beautiful city in the world leaving behind Istanbul and Bangkok. Udaipur, known for ‘The City Of Lakes’ has the waterfront properties foreign investors going crazy for. Tourist spots like Vallabhnagar lake and Bhatewar lake are attracting investors and people are building their farmhouses with beautiful landscape, amidst scenic surroundings. Lake Front properties are selling like hot cupcakes in that locality. Being second most beautiful city in the world, the real estate landscape of this city is changing very rapidly. Local investors as well as NRI investors are looking to invest in properties in Udaipur because of its rich heritage, culture and scenic beauty of nature around the city, Various investors are opting for farm land in the outskirts of the city preferring locality nearby airport and making their weekend homes and farmhouses amidst scenic surroundings and driving rental income by leasing or farming on their land. Why more people are driving towards investing in farmhouses? Farmhouses that are being rented out for events are in high demand nowadays due to the trend set and the fact that the area is larger than banquet halls, at a beautiful location, far away from the crowd and noise of the city centre. This trend has become famous via several movies and social media influencers where celebrities post pictures of spending time at their farmhouses with friends and family, partying, hanging out, and chilling. Seeing this, farmhouses started becoming popular as party spots as they are available in an isolated location with lots of greenery around, where noise won’t be an issue.. The category of people that can be seen investing in farm land and building their farmhouses in the outskirts is the ones who already have homes and investing for the reason of having a second home or luxury purposes. The land buying options are aimed towards having a spacious and cozy house. Farmhouses today host a new sub-culture for India’s lifestyle conscious and high net worth class of people. Localities in Udaipur that will most likely give you big capital gains ! The area where government schemes is launching or any upcoming infrastructure development coming, most likely these areas is going to drive huge returns to your investment. In Udaipur, Airport Road is proving to be emerging as a real estate hotspot for investors. After declaration of Maharana Pratap Airport becoming International Airport, investors from around the globe are showing their keen interest in Udaipur Real Estate. Foreign companies are developing their projects on airport road which is going to be beneficial in uplifting the real estate market scenario of Udaipur. Rajasthan Housing Board and Singapore Enterprise Coorperation jointly came up with the planning of two Singapore based township one in Udaipur and One in Jodhpur. In Udaipur, the township is planned on 1000 acres on airport road, which will fetch higher ROI for properties located in that locality. The development is happening at a very fast pace in and around Udaipur, due to which overcrowding in the main city is making people wanting to live in nature more than ever. IN CONCLUSION If you’re looking for a long term wealth creation opportunity in agriculture or farm land around Udaipur, Gokul Properties has solution for you. You can invest in farm land with us in installments with 0% interest. Invest your money in a secure oasis in the second most beautiful and romantic city of the world. As the intrinsic value of a farm land never goes down. You can always dispose of portions of your farmland at any point of time as the demand for farmland continues to rise as the supply keeps steadily going down. Our projects are located in the most handpicked locations of the city, around famous and most beautiful tourist spots of Udaipur where you can build your weekend home and enjoy the peaceful living over there. A farm land will provide a much bigger chunk of land, where one can easily build their dream weekend home, with no restrictions such as space and size. The land would be fertile and fit for agricultural practices, so one can grow crops for their family in that land or simply lease it out to those involved in agricultural practices to ensure that the land doesn’t remain unutilized

Read MoreLegal Aspects Of Real Estate Transactions in Udaipur

In the vibrant real estate market of Udaipur, understanding the legal landscape is pivotal for a seamless and secure . In this blog post, we’ll delve into the crucial legal aspects that every prospective buyer should be aware of when navigating the Udaipur real estate scene. 1. Legal Framework: The Foundation of Real Estate Transactions Before diving into a real estate transaction, it’s essential to grasp the legal framework governing . Familiarize yourself with the relevant laws, including the Real Estate (Regulation and Development) Act, to ensure compliance and protect your interests. 2. Title Verification: Ensuring Clear Ownership One of the foremost legal considerations is confirming the title of the property. Engage legal professionals to conduct a thorough title search, ensuring that the seller possesses clear and marketable ownership rights. This step is vital in preventing future disputes and securing your investment. 3. Land Use Regulations: Complying with Zoning Laws Udaipur, like any other city, has specific zoning laws and land use regulations. Understanding these guidelines is crucial to confirming the property’s designated use and ensuring it aligns with your intended purposes. Violations could lead to complications down the line, emphasizing the importance of compliance. 4. Sale Deed Authentication: Formalizing Property Ownership The sale deed is a legal document that officially transfers ownership from the seller to the buyer. Ensure the authenticity of this document by verifying it with legal experts. A legally sound sale deed is essential for establishing your rightful ownership of the property. 5. Encumbrance Certificate: Assessing Property Liabilities Obtaining an encumbrance certificate is a critical step in assessing the property’s financial liabilities. This document verifies whether the property is free from legal dues and mortgages. It provides transparency on the property’s financial history, protecting you from potential legal complications. 6. Due Diligence on Approvals and Permissions Before finalizing any real estate deal, confirm that the property has obtained all necessary approvals and permissions from relevant authorities. This includes approvals for construction, environmental clearances, and compliance with local building codes. Ensuring adherence to regulations safeguards your investment and avoids future legal challenges. 7. Stamp Duty and Registration: Legal Obligations for Document Validity Understanding the stamp duty and registration fees applicable to your property transaction is crucial. Paying these fees in adherence to legal requirements is essential for validating your property documents. Failure to comply can render your transaction legally invalid. 8. Legal Assistance: Partnering with Expertise Navigating the legal intricacies of real estate transactions can be complex. Seeking legal assistance from experienced professionals in Udaipur ensures that you have a knowledgeable ally guiding you through the legal maze. Expert advice minimizes risks and ensures a legally sound property investment. Conclusion: Empowering Your Real Estate Journey with Legal Knowledge and Gokul Properties In the intricate landscape of real estate transactions in Udaipur, a comprehensive understanding of legal aspects is paramount for a secure investment. Gokul Properties stands out as a beacon of reliability and expertise in the Udaipur real estate market. With a commitment to transparency, legal integrity, and client satisfaction, Gokul Properties brings a wealth of experience to every transaction. Our team of seasoned professionals specializes in navigating the legal intricacies, ensuring that your property journey is not only legally sound but also streamlined and stress-free. In conclusion, as you embark on your real estate journey in Udaipur, choose Gokul Properties for a seamless, legally sound, and rewarding experience. Their commitment to excellence, paired with a wealth of expertise, makes us the ideal partner for turning your real estate aspirations into a tangible reality. Trust Gokul Properties to navigate the legal intricacies and elevate your real estate journey to new heights.

Read MoreA Strategic Guide to Boosting Your Credit Score for Property Loans

In the pursuit of your dream property asset, securing the right real estate loan is paramount. Your credit score stands as the key factor influencing loan terms and interest rates. In this blog post, we’ll unravel the importance of a robust credit score for loans and offer actionable strategies to enhance your creditworthiness. Understanding the Significance of Credit Scores in Real Estate Financing Before delving into credit score improvement strategies, let’s grasp the crucial role it plays in the real estate financing landscape. A credit score, ranging from 300 to 850, serves as a numeric representation of your creditworthiness. Lenders rely on this score to evaluate the risk associated with lending to you, influencing the terms and rates of your real estate loan. 1. Review Your Credit Report Regularly for Precision Initiate your credit score enhancement journey by obtaining a copy of your credit report from major bureaus or online portals. Rigorously scrutinize the report for inaccuracies, discrepancies, or unresolved debts. Swiftly dispute any errors you discover, as these inaccuracies can adversely affect your credit score. 2. Timely Bill Payments: The Cornerstone of Credit Health Consistently paying bills on time is fundamental to building a positive credit history. Leverage automated payments or set reminders to ensure punctuality. Timely payments not only demonstrate financial responsibility but also contribute significantly to elevating your credit score. 3. Reduce Credit Card Balances for Optimal Utilization High credit card balances relative to your credit limit can negatively impact your credit score. Aim to maintain a credit card utilization ratio below 30%. If feasible, prioritize paying down outstanding balances to your improved credit utilization ratio and showcase responsible credit management. 4. Diversify Credit Mix Responsibly A diverse credit mix, encompassing credit cards, installment loans, and retail accounts, can positively influence your credit score. However, prudent management of these accounts is imperative. Steer clear of opening multiple new accounts rapidly, as this may raise concerns for lenders. 5. Retain Older Accounts for Extended Credit History The length of your credit history significantly influences your credit score. Avoid closing older accounts, even if inactive, to preserve a positive credit history. Maintaining these accounts contributes to a robust credit profile. 6. Collaborate with Creditors on Negotiated Payment Plans Open communication with creditors is pivotal if facing financial challenges. Many creditors are amenable to negotiating payment plans or settling for reduced amounts. Establishing and fulfilling agreed-upon plans can positively impact your credit score for property loans. 7. Seek Expert Guidance for a Tailored Approach If navigating credit score improvement feels daunting, consider engaging with a credit counseling agency. These professionals offer personalized advice, assist in budget creation, and guide you through the process of enhancing your creditworthiness. Conclusion: Paving the Way to Your Dream Home with Enhanced Credit Scores As you embark on your home financing journey, recognize that a robust credit score for real estate financing is your ticket to favorable loan terms. By implementing these actionable steps and maintaining responsible financial habits, you not only enhance your creditworthiness but also position yourself for success in the competitive real estate market. Your dream home is on the horizon – let your fortified credit score be the catalyst that propels you towards homeownership.

Read MoreThe Advantages of 0% Interest EMIs for Real Estate Investments In Udaipur

In the dynamic realm of real estate, the journey to homeownership often comes with financial challenges. For prospective buyers eyeing the enchanting city of Udaipur and its burgeoning real estate market, a game-changing opportunity awaits – 0% Interest EMIs. In this blog post, we’ll delve into the unparalleled advantages of this financing option, comparing it with traditional financing models and shedding light on how it empowers individuals to turn their real estate dreams into reality. 1. Breaking the Interest Shackles: The Power of 0% Interest EMIs One of the most compelling aspects of 0% Interest EMIs is the absence of interest charges. Unlike traditional financing where interest payments can significantly inflate the overall cost of the property, a 0% interest plan ensures that every penny paid goes towards the principal amount. This not only accelerates the equity-building process but also allows buyers to save substantial amounts in the long run. 2. Affordability Redefined: Easy on the Pocket, Light on the Mind The burden of interest can often make monthly payments a source of stress for many homebuyers. With 0% Interest EMIs, the financial strain is considerably reduced. Monthly payments remain consistent and predictable, offering a level of financial stability that traditional financing may not provide. This affordability factor opens the doors to homeownership for a broader spectrum of individuals, making real estate investments more inclusive and accessible. 3. Faster Path to Ownership: Speeding Up Equity Accumulation Traditional financing models necessitate a significant portion of monthly payments to go towards interest, slowing down the process of building equity in the property. In contrast, 0% Interest EMIs expedite the accumulation of equity, allowing buyers to assert ownership and increase their stake in the property at a much faster rate. This not only enhances financial security but also facilitates quicker progress towards potential resale or further investments. 4. Transparent and Predictable: Know Your Costs from Day One One of the key advantages of 0% Interest EMIs lies in their transparency. Buyers can anticipate and plan their finances with precision, knowing that their monthly payments won’t fluctuate due to interest rate variations. This predictability fosters better financial management and eliminates the uncertainties associated with traditional financing, providing peace of mind throughout the repayment period. 5. The Comparative Edge: Traditional Financing vs. 0% Interest EMIs Now, let’s draw a comparison between traditional financing and 0% Interest EMIs. Traditional loans often come with interest rates that can substantially increase the total repayment amount. The interest component not only extends the duration of repayment but also adds a considerable financial burden. In contrast, 0% Interest EMIs eliminate the interest factor entirely, resulting in lower overall costs and a shorter repayment period. This comparative edge positions 0% Interest EMIs as an attractive and financially prudent option for real estate investments. In conclusion, the advantages of 0% Interest EMIs for real estate investments in Udaipur are clear and compelling. By offering a transparent, affordable, and faster route to homeownership, this financing option empowers buyers to seize the opportunities presented by the vibrant real estate market in Udaipur. It’s not just a financial arrangement; it’s a key that unlocks the door to a brighter, more accessible future in real estate investment.

Read MoreSmart Investments for Beginners: Exploring the Advantages of Investing in Plots near Udaipur International Airport

Introduction: Embarking on the journey of investment can be both exciting and daunting, especially for beginners. Selecting the right type of investment that aligns with one’s financial goals and provides long-term benefits is crucial. In this blog, we’ll delve into the wisdom of investing in plots located near Udaipur International Airport, exploring the various advantages that make it an attractive option for novice investors. Strategic Location and Connectivity: Udaipur International Airport’s strategic location and excellent connectivity make the surrounding areas prime real estate for investment. The airport’s presence often attracts infrastructural development, including improved roads and transportation networks, enhancing the overall accessibility and value of nearby properties. Potential for Appreciation: Investing in plots near Udaipur International Airport presents the potential for property appreciation over time. As the airport facilitates economic growth and attracts business activities, the demand for land in the vicinity is likely to increase, leading to a rise in property values. This appreciation can provide beginners with a favorable return on investment. Growing Tourism Industry: Udaipur, known for its rich cultural heritage and scenic beauty, is a popular tourist destination. Proximity to the international airport can be advantageous, especially considering the growing tourism industry. Investors may find opportunities in developing properties for hospitality services, catering to the influx of tourists, and tapping into the vibrant local economy. Infrastructure Development: Investment in plots near Udaipur International Airport often aligns with ongoing and future infrastructure development plans. Local authorities may focus on improving amenities, utilities, and civic facilities in response to the airport’s growth, providing an added benefit for those investing in the area. Strategic Business Opportunities: The presence of an international airport attracts not only tourists but also businesses seeking strategic locations for offices, warehouses, and logistics hubs. Investors can capitalize on the demand for commercial spaces, potentially leasing or selling properties to businesses looking to establish themselves in a thriving economic zone. Diversification and Tangible Assets: For beginners, investing in real estate, particularly plots, offers a tangible and physical asset. Diversifying a portfolio with real estate can provide a sense of security and stability, as land is a finite resource with intrinsic value. This can serve as a valuable addition to a diversified investment strategy. Conclusion: For beginner investors, choosing the right investment avenue is crucial for long-term financial success. Investing in plots near Udaipur International Airport emerges as a wise choice due to its strategic location, growth potential, and the various opportunities it presents. As the city and the airport continue to evolve, those who wisely invest in these promising areas may find themselves on the path to financial prosperity.

Read MoreZero Interest EMIs vs. Traditional Mortgages: Which is Better for You?

Buying a plot in udaipur is one of the most significant financial decisions you’ll ever make. To turn this dream into a reality, you have several financing options at your disposal. Two of the most common approaches are traditional mortgages and zero interest EMIs (Equated Monthly Installments). Both have their advantages, but they cater to different financial situations and objectives. In this blog, we’ll compare the benefits of zero interest EMIs and traditional mortgages to help you make an informed decision about which option is better for you. Traditional Mortgages: A Time-Tested Approach Traditional mortgages are the most common method of financing a home purchase. Here’s how they work: Interest Charges: Traditional mortgages involve borrowing a sum of money from a financial institution, and in return, you pay back the principal amount along with interest charges. Interest rates can fluctuate and add a substantial cost to the total amount repaid. Longer Loan Tenures: Mortgage loans often come with longer loan tenures, typically ranging from 15 to 30 years. While this can lead to lower monthly payments, it also means you’ll pay more interest over time. Down Payment: Traditional mortgages require a down payment, typically a percentage of the property’s purchase price. This down payment can vary but is usually around 20% of the property’s value. Credit Checks: Mortgage lenders conduct thorough credit checks to assess your creditworthiness, and approval is based on your credit score and financial history. Fixed or Variable Interest Rates: Mortgages can have either fixed or variable interest rates. Fixed rates remain constant over the loan term, while variable rates can change over time. Zero Interest EMIs: The Innovative Approach Zero interest EMIs have gained popularity as an alternative financing option. Here’s how they differ from traditional mortgages: No Interest Charges: The most significant advantage of zero interest EMIs is right in the name – there are no interest charges. You only pay back the principal amount in equal monthly installments. Shorter Loan Tenures: Zero interest EMIs usually have shorter loan tenures, typically ranging from 5 to 10 years. The shorter term means you’ll pay off your loan faster. Affordability: Zero interest EMIs offer greater affordability by breaking down the total cost of the property into smaller, more manageable monthly installments. There’s no need for a hefty down payment. No Credit Checks: These financing options generally don’t require credit checks. Approval is often based on your income and ability to make regular payments. Predictable Payments: Zero interest EMIs offer predictability in your monthly payments. You know exactly how much you’ll pay each month throughout the loan tenure. Choosing the Right Option: What Works for You? The decision between zero interest EMIs and traditional mortgages depends on your financial situation and goals: If you prefer long-term affordability: Traditional mortgages offer lower monthly payments, making them suitable for those who intend to stay in their homes for an extended period. If you want to minimize interest costs: Zero interest EMIs eliminate interest charges, allowing you to pay off your loan faster and save money in the long run. If you have a substantial down payment: Traditional mortgages might be more accessible if you have the means for a down payment and a strong credit history. If you need a more flexible financing option: Zero interest EMIs are often more flexible, with shorter loan tenures and minimal credit requirements. In conclusion, the choice between zero interest EMIs and traditional mortgages depends on your financial goals, lifestyle, and personal circumstances. Each option has its unique advantages, and the right choice for you will depend on what aligns with your homeownership aspirations. It’s essential to carefully consider your financial situation and preferences before making a decision that will shape your homeownership journey.

Read MorePlots On Zero Interest EMIs: Unlocking the Door to smart ownership

The dream of owning a home is one of the most significant aspirations for individuals and families around the world. However, the high costs associated with buying a property often seem insurmountable. Traditional mortgage options may not always be accessible, and the prospect of paying substantial interest over the loan tenure can be discouraging. But what if there was a way to make homeownership more achievable without the burden of high-interest rates? This is where zero interest EMIs come into play, and they can be the key to unlocking the door to property ownership. How Zero Interest EMIs Work? Here’s how zero interest EMIs can make plot ownership a reality: 1. Affordability: Zero interest EMIs break down the property’s total cost into smaller, manageable monthly installments. This affordability is a game-changer for individuals and families who might otherwise struggle to save for a substantial down payment or qualify for a traditional mortgage. 2. No Interest Accumulation: As the name suggests, zero interest EMIs don’t accumulate any interest over the loan tenure. This means that the homebuyer pays only the principal amount and no extra charges. The absence of interest can save homebuyers a significant amount of money over time. 3. Predictable Payments: With zero interest EMIs, the monthly payments remain consistent throughout the loan period. Homebuyers can budget and plan their finances effectively, knowing exactly how much they need to pay each month. 4. Flexible Tenure: Zero interest EMI options often come with flexible tenure choices. Homebuyers can select a tenure that suits their financial situation, whether it’s a short-term plan to repay the loan quickly or a longer-term plan to reduce the monthly installment amount. Making plot ownership a Reality with Gokul Properties The benefits of zero interest EMIs extend beyond affordability and predictability. They have the power to make real estate ownership a reality for a wide range of people, including: 1. First-Time Property buyers: Individuals or families looking to purchase their first property can benefit from zero interest EMIs, as it offers them a more accessible entry into the real estate market. 2. Young Professionals: Young professionals who have just started their careers may find it challenging to save a substantial down payment. Zero interest EMIs provide an opportunity to own a home without a massive upfront financial commitment. 3. Investors: Real estate investors can use zero interest EMIs to expand their property portfolio and potentially earn rental income. The predictable payments make it easier to manage multiple properties. 4. Retirees: Those who are retired or nearing retirement may want to downsize or invest in a more manageable property. Zero interest EMIs offer them an affordable way to do so. **The Role of Our Company** At Gokul Properties , we understand the significance of plot ownership and the challenges that potential buyers face. That’s why we offer zero interest EMIs to help individuals and families achieve their dreams of owning a property . Our zero interest EMI option is designed to make plot ownership accessible and affordable, ensuring that no one is left behind in the pursuit of their dream home. In conclusion, zero interest EMIs are a powerful tool that can unlock the door to property ownership for many who thought it was out of reach. They provide affordability, predictability, and the opportunity to own a home without the burden of high-interest rates. If you’ve ever dreamt of owning a home, consider exploring zero interest EMIs as a pathway to make that dream a reality. Book your plot with Gokul Properties today and buy your plot with easy down payment and zero percent interest installments.

Read MoreInvesting in Udaipur Real Estate: Why Proximity to an International Airport Matters

When it comes to real estate investment, location is often the key factor that can make or break your decision. One location factor that has been gaining prominence in recent years is proximity to international airports. Owning a plot near an international airport can offer a multitude of advantages that make it an attractive choice for investors. In this blog, we will delve into why investing in real estate near an udaipur international airport matters and explore the numerous benefits it brings. 1. Increased Property Value One of the most significant advantages of owning property near an international airport is the potential for increased property value. Airports are hubs of economic activity, and their presence can drive development in the surrounding areas. As more businesses and amenities are established to cater to travelers, property values tend to rise. This means that your real estate investment is more likely to appreciate over time, offering you the prospect of a higher return on investment. 2. Convenience for Travelers Proximity to an international airport is not only appealing to property investors but also to travelers. Many people, including business professionals and tourists, seek accommodations that are close to the airport to reduce travel time and simplify their journeys. As an investor, this translates to a larger pool of potential renters or buyers for your property. The convenience factor can make your real estate investment more appealing and profitable. 3. Rental Income Opportunities: Owning a property near an international airport provides you with an excellent opportunity for rental income. Travelers often seek short-term accommodations, such as vacation rentals or serviced apartments. By investing in real estate near the airport, you can tap into this demand. You can rent out your property on platforms like Airbnb or to business travelers looking for a comfortable place to stay during their trips. This additional income stream can significantly boost your return on investment. 4. Accessibility and Connectivity: International airports are well-connected transportation hubs. This means that owning property near an airport gives you excellent accessibility to various modes of transportation, including flights, trains, and major roadways. Easy access to these transportation options can be a valuable asset, whether you use the property for personal purposes or as a rental investment. 5. Economic Growth and Development: Airports often act as catalysts for economic growth and development in their vicinity. With the growth of the airport, businesses, hotels, restaurants, and retail establishments tend to flourish. This can lead to an increase in job opportunities, further driving up the demand for real estate in the area. 6. Resilience in Market Fluctuations: Properties near international airports tend to be more resilient to market fluctuations. They are often considered stable investments, as the demand for accommodations and services around airports remains relatively constant. This stability can provide peace of mind to investors, especially during economic uncertainties. In conclusion, investing in real estate near an international airport offers a range of advantages, including increased property value, convenience for travelers, rental income opportunities, enhanced accessibility, and the potential for economic growth. It’s a strategic choice that aligns well with the modern lifestyle and travel preferences. Before making any real estate investment, it’s crucial to conduct thorough research and due diligence to ensure that the location near the international airport aligns with your investment goals and objectives.

Read More